NY DTF IT-285 2024-2025 free printable template

Show details

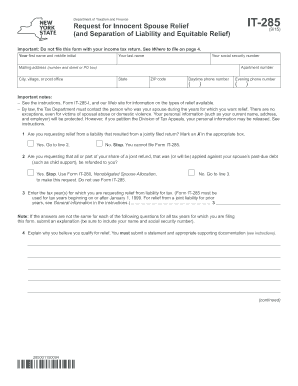

IT-285 Department of Taxation and Finance Request for Innocent Spouse Relief and Separation of Liability and Equitable Relief 12/24 Important Do not file this form with your income tax return. See Where to file on page 4. 15 Did you file federal Form 8857 Request for Innocent Spouse Relief with the IRS for the same tax years and with the same missing or incorrect items on your returns for which you are filing this form Yes. Your first name and middle initial Your last name Your Social...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-285

Edit your NY DTF IT-285 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-285 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF IT-285 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF IT-285. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-285 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-285

How to fill out NY DTF IT-285

01

Collect all necessary documents, including your tax returns and information regarding income adjustments.

02

Obtain the NY DTF IT-285 form from the New York State Department of Taxation and Finance website or your local tax office.

03

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

04

Complete the sections regarding your federal adjusted gross income and any modifications specific to New York.

05

Carefully follow the instructions for calculating your New York State tax credits or refunds.

06

Review your completed form for accuracy, ensuring all numbers are correct and every section is filled out.

07

Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

08

Submit the completed IT-285 form by the tax deadline, either electronically or via mail.

Who needs NY DTF IT-285?

01

Individuals who are residents of New York State and are claiming a personal income tax credit.

02

Taxpayers who have filed a New York State income tax return and are eligible for adjustments or refunds.

03

Those who want to report specific income adjustments related to New York State taxes.

Fill

form

: Try Risk Free

People Also Ask about

How to get $7,000 tax refund?

Below are the requirements to receive the Earned Income Tax Credit in the United States: Have worked and earned income less than $59,187. Have investment income less than $10,300 in tax year 2022. Have a valid Social Security number by the due date of your 2021 return.

What percentage does the IRS settle for?

The taxpayer has a right to specify the particular tax liability to which the IRS will apply the 20 percent payment. Periodic Payment Offer – An offer is called a "periodic payment offer" under the tax law if it's payable in 6 or more monthly installments and within 24 months after the offer is accepted.

Does IRS ever negotiate settlements?

An offer in compromise allows you to settle your tax debt for less than the full amount you owe. It may be a legitimate option if you can't pay your full tax liability or doing so creates a financial hardship. We consider your unique set of facts and circumstances: Ability to pay.

What is the $1400 tax relief?

The maximum credit is $1,400 per person, including all qualifying dependents claimed on a tax return. Typically, this means a single person with no dependents will have a maximum credit of $1,400, while married taxpayers who file a joint return that claims two qualifying dependents will have a maximum credit of $5,600.

What does tax relief do?

Tax relief constitutes government programs or policies that help lessen the burden of taxes for individuals. These are usually done through tax deductions, credits, and exclusions. When filing your taxes, make sure you take advantage of all of these options so that you don't end up paying more taxes than you need to.

How much will the IRS usually settle for?

How much will the IRS settle for? The IRS will typically only settle for what it deems you can feasibly pay. To determine this, it will take into account your assets (home, car, etc.), your income, your monthly expenses (rent, utilities, child care, etc.), your savings, and more.

What is an example of a tax relief?

For example, a $1,000 tax credit lowers your tax bill by that same $1,000. Meanwhile, a $1,000 tax deduction lowers your taxable income by that amount. So, if you fall into the 24% tax bracket, a $1,000 deduction would shave $240 off of your tax bill.

How do I get a $10000 tax refund 2023?

CAEITC Be 18 or older or have a qualifying child. Have earned income of at least $1.00 and not more than $30,000. Have a valid Social Security Number or Individual Taxpayer Identification Number (ITIN) for yourself, your spouse, and any qualifying children. Living in California for more than half of the tax year.

What is tax relief mean?

Tax relief is a broad term that means that the amount of tax you have to pay is reduced. It can reduce your tax bill, or it can mean that some of the tax you have already paid is returned to you. It is called 'relief' because it reduces your overall tax burden.

What can you get tax relief on?

If you're employed under PAYE some of the popular ways you can secure tax relief against your income tax are: Mileage tax relief… Professional fees tax relief. Tools tax relief. Uniform tax relief. Higher rate pension tax relief. Flat rate expenses tax relief. Working from home tax relief.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute NY DTF IT-285 online?

pdfFiller has made it simple to fill out and eSign NY DTF IT-285. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an eSignature for the NY DTF IT-285 in Gmail?

Create your eSignature using pdfFiller and then eSign your NY DTF IT-285 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit NY DTF IT-285 on an Android device?

You can make any changes to PDF files, such as NY DTF IT-285, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NY DTF IT-285?

NY DTF IT-285 is a New York State tax form used for claiming a refund of New York State personal income tax credits and for tax withholding adjustments.

Who is required to file NY DTF IT-285?

Individuals who are claiming the New York State credit for taxes withheld or estimated payments and those who are eligible for certain tax credits may be required to file NY DTF IT-285.

How to fill out NY DTF IT-285?

To fill out NY DTF IT-285, taxpayers should provide their personal information, including name, address, social security number, and fill in the relevant sections concerning tax credits and withholding adjustments.

What is the purpose of NY DTF IT-285?

The purpose of NY DTF IT-285 is to allow taxpayers to claim refunds for overpaid taxes, credits for withheld amounts, and to report any relevant tax credit information to the New York State Department of Taxation and Finance.

What information must be reported on NY DTF IT-285?

Information that must be reported on NY DTF IT-285 includes personal identification details, total income, amounts withheld, tax credits being claimed, and any adjustments related to estimated tax payments.

Fill out your NY DTF IT-285 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-285 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.